Common Misconceptions About Travel Insurance

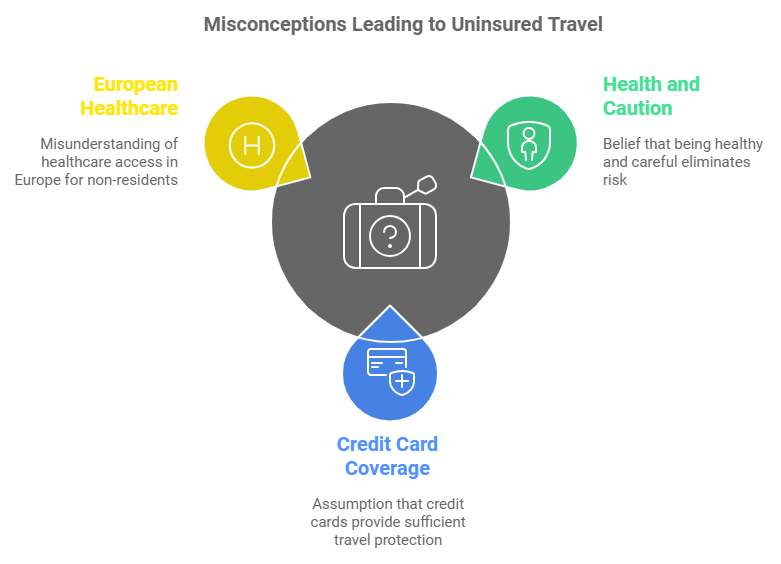

Many travelers opt out of purchasing travel insurance due to several misconceptions:

- “I’m Healthy and Careful”: Accidents and illnesses can happen to anyone, regardless of health status or caution.

- “My Credit Card Covers Me”: Credit card travel protections are often limited and may not cover medical emergencies or trip cancellations comprehensively.

- “Europe Has Free Healthcare”: While some European countries offer subsidized healthcare, it’s typically only for residents or EU citizens.

Medical Costs in Spain

Spain boasts an excellent healthcare system, but it’s important to note that it’s not free for tourists from non-EU countries.

Here’s a breakdown of potential medical costs you might incur without insurance:

| Medical Service | Approximate Cost (EUR) |

|---|---|

| General Practitioner Visit | €100 – €150 |

| Emergency Room Visit | €200 – €400 |

| Hospital Stay (per day) | €600 – €800 |

| Surgery (e.g., Appendectomy) | €5,000 – €10,000 |

| Ambulance Transportation | €400 – €600 |

| Prescription Medication | €20 – €100 |

An unexpected medical emergency can quickly escalate into thousands of euros in expenses.

For example, a simple fracture could require surgery and a hospital stay, potentially costing upwards of €7,000.

Other Risks While Traveling

Lost or Delayed Luggage

Luggage mishandling by airlines is more common than most people realize. In fact, according to the SITA Baggage Report of 2022, around 4.35 bags per 1,000 passengers were mishandled globally in 2021.[/su_note]

While this may seem like a small percentage, if you’re the one standing at the baggage claim without your suitcase, it can quickly become a frustrating and costly experience.

Flight Cancellations and Delays

Flight disruptions are one of the most common issues travelers face, whether it’s due to bad weather, technical issues, or overbooking.

Having a flight canceled or significantly delayed can derail your entire travel itinerary. Without travel insurance, you might find yourself paying out of pocket for new flights, extra nights in hotels, and meals while you wait for the next available flight.

These unexpected expenses can quickly add up, particularly if you’re traveling during peak times when flights and accommodations may already be expensive.

A comprehensive travel insurance policy typically covers such situations, ensuring you can rebook flights or extend your stay without shouldering the full financial burden.

Theft and Pickpocketing

While Spain is generally a safe country for tourists, certain cities, particularly popular ones like Barcelona and Madrid, have gained reputations as hotspots for pickpocketing. Public places such as crowded markets, public transportation, and tourist attractions are where theft is most likely to occur.

If your wallet, passport, or valuable items like electronics are stolen, the financial and emotional toll can be considerable.

You may need to replace important documents like your passport, cancel credit cards, or buy a new phone or camera. Without insurance, you’d be responsible for these costs.

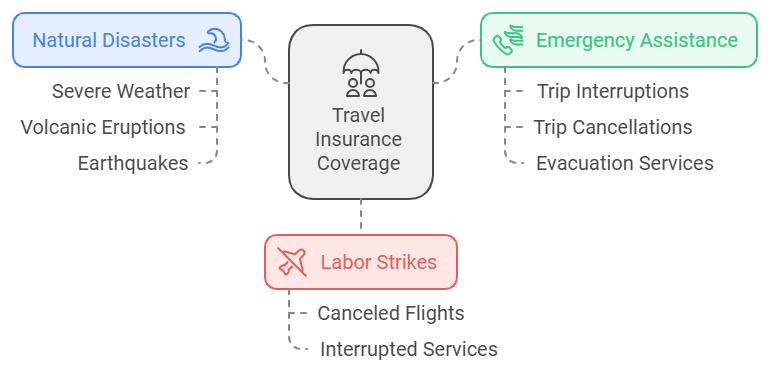

Natural Disasters and Strikes

Although rare, natural disasters or labor strikes can have a significant impact on travel plans.

Most comprehensive policies provide coverage for trip interruptions or cancellations caused by such unforeseen events. If evacuation is necessary, some policies also include emergency assistance services, ensuring you receive the necessary help in a crisis.

Personal Accidents and Injuries

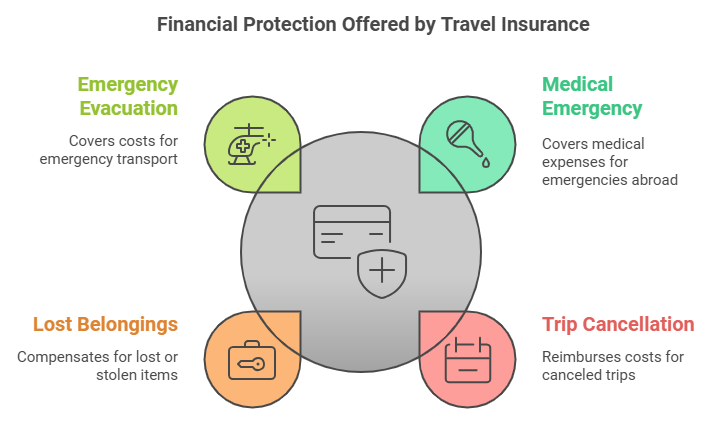

In case of an accident that results in medical attention, an emergency evacuation, or hospitalization, the costs can be extremely high, especially for non-EU citizens.

Without travel insurance, you could end up facing enormous out-of-pocket expenses for medical treatment.

Even something as simple as a broken leg or sprained ankle could result in significant medical bills.

However, with adequate travel insurance, your medical costs, including treatment, hospital stays, and even medical evacuations, can be covered, giving you peace of mind.

Trip Cancellations Due to Illness or Emergency

Sometimes life throws unexpected curveballs, and you might need to cancel or cut short your trip due to illness, injury, or family emergencies.

Without travel insurance, non-refundable bookings—whether for flights, accommodations, or activities—are typically lost, leaving you out-of-pocket.

This can be especially helpful for expensive international trips where a sudden change in plans could lead to substantial financial losses.

Missed Connections

If you’re traveling on a tight schedule with multiple connecting flights, a missed connection can throw off your entire itinerary.

Whether your initial flight is delayed or canceled, missing a connecting flight can result in having to rebook and possibly pay for a new flight or hotel stay.

Without travel insurance, these added costs can become a significant burden.

Rental Car Accidents or Damage

Renting a car while exploring Spain is a popular choice for many travelers, especially those looking to visit rural areas or explore the country at their own pace.

However, accidents or damage to a rental car can lead to costly repairs or even legal liabilities.

Even if you have car insurance at home, it may not extend to international rentals.

This protection ensures you’re not paying exorbitant fees for damage or accidents involving a rental car.

Cost of Travel Insurance vs. Potential Expenses

Investing in travel insurance is relatively inexpensive compared to the potential costs of unexpected incidents.

Average Travel Insurance Costs for a Two-Week Trip to Spain

| Age Group | Policy Cost (USD) |

|---|---|

| 18-30 | $50 – $80 |

| 31-50 | $70 – $120 |

| 51-65 | $100 – $150 |

| 66+ | $150 – $250 |

Potential Out-of-Pocket Expenses Without Insurance

- Medical Emergency: €5,000 – €10,000

- Trip Cancellation: Up to the total cost of your trip

- Lost or Stolen Belongings: €1,000 – €3,000

- Emergency Evacuation: €20,000 – €50,000

By comparing these figures, it’s evident that the cost of travel insurance is minimal compared to potential expenses.

Legal Requirements and Schengen Visa Regulations

For travelers from certain countries, obtaining a Schengen visa is a prerequisite for entering Spain.

One of the requirements for a Schengen visa is proof of travel insurance with a minimum coverage of €30,000 for medical emergencies according to AXA.